How to Manage Money After Marriage: A Comprehensive Guide

Here are some essential steps and strategies to help you and your spouse manage your finances effectively.

1. Open Communication

Why It’s Important:

Open and honest communication about money sets the foundation for a healthy financial relationship.Both partners should be aware of each other's financial habits, goals, and concerns.

How to Do It:

- Discuss Financial Histories: Share your financial backgrounds, including debts, savings, and spending habits.

- Set Financial Goals: Establish both short-term and long-term financial goals together,

- such as buying a house, saving for retirement, or planning vacations.

2. Create a Joint Budget

Why It’s Important:

A joint budget helps track income and expenses, ensuring both partners are aligned with their financial goals and obligations.How to Do It:

- List All Income Sources: Include salaries, bonuses, investments, and any other income.

- Track Expenses: Categorize and track monthly expenses such as rent/mortgage, utilities, groceries, entertainment, and savings.

- Set Limits: Agree on spending limits for discretionary expenses and stick to them.

3. Combine Finances Strategically

Why It’s Important:

Combining finances can simplify money management, but it’s essential to do it in a way that suits both partners.How to Do It:

- Joint Accounts: Consider opening joint accounts for shared expenses like rent, utilities, and groceries.

- Individual Accounts: Maintain individual accounts for personal spending to ensure financial independence.

- Hybrid Approach: Use a combination of joint and individual accounts to balance shared responsibilities and personal autonomy.

4. Emergency Fund

Why It’s Important:

An emergency fund provides financial security in case of unexpected expenses like medical emergencies or job loss.How to Do It:

- Save Regularly: Aim to save three to six months' worth of living expenses.

- Separate Account: Keep the emergency fund in a separate, easily accessible savings account.

5. Debt Management

Why It’s Important:

Managing debt effectively prevents financial strain and improves credit scores.How to Do It:

- List Debts: Compile a list of all debts, including credit cards, student loans, and mortgages.

- Prioritize Payments: Focus on paying off high-interest debts first while making minimum payments on others.

- Consolidate if Needed: Consider debt consolidation to lower interest rates and simplify payments.

6. Invest Together

Why It’s Important:

Investing together helps build wealth and achieve long-term financial goals.How to Do It:

- Diversify Investments: Spread investments across different asset classes such as stocks, bonds, and real estate.

- Retirement Accounts: Contribute to retirement accounts like 401(k)s, IRAs, or CPF (in Singapore) to ensure a comfortable retirement.

- Regular Reviews: Review your investment portfolio periodically to make necessary adjustments.

7. Plan for Major Expenses

Why It’s Important:

Planning for major expenses prevents financial surprises and ensures you have enough funds when needed.

How to Do It:

- Set Priorities: Determine which major expenses, such as buying a house, car, or having children, are priorities.

- Save in Advance: Start saving for these expenses well in advance to avoid taking on excessive debt.

8. Regular Financial Check-ins

Why It’s Important:

Regular financial check-ins ensure both partners stay on track with their financial goals and make necessary adjustments.How to Do It:

- Monthly Meetings: Schedule monthly financial meetings to review budgets, expenses, and savings.

- Adjust Goals: Adjust financial goals as needed based on changes in income, expenses, or life circumstances.

9. Protect Your Assets

Why It’s Important:

Protecting your assets ensures financial security and peace of mind.

How to Do It:

- Insurance: Ensure you have adequate insurance coverage, including health, life, home, and auto insurance.

- Wills and Estate Planning: Create wills and establish an estate plan to protect your assets and ensure they are distributed according to your wishes.

Conclusion

Managing money after marriage requires cooperation, communication, and careful planning.By following these strategies, you and your spouse can build a strong financial foundation, achieve your goals,

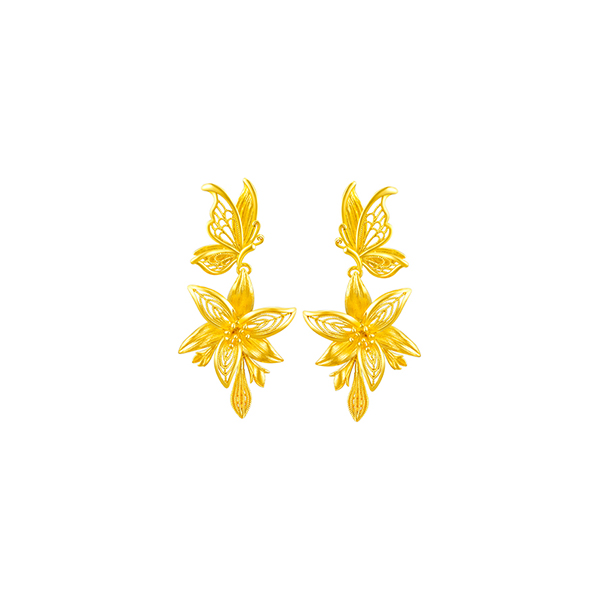

and enjoy a harmonious and prosperous life together. Remember, at ALUXE,

we’re here to help you make informed financial decisions as you embark on this beautiful journey.

Visit our store to find the perfect rings and start your married life with elegance and confidence.